The 2025-2026 Free Application for Federal Student Aid (FAFSA), which applies to the Fall 2025, Spring 2026 and Summer 2026 academic year, is available until June 30, 2026.

The 2026-2027 FAFSA, which applies to the Fall 2026, Spring 2027 and Summer 2027 academic year, will be available December 1, 2025. TCNJ’s priority application deadline is February 15, 2026. The State of New Jersey’s FAFSA application deadline is April 15, 2026.

FAFSA updates 2026/2027:

For the 2026-2027 FAFSA, updates include a more streamlined form, a simplified contributor invitation process requiring only an email address, and changes to how some assets are calculated for Pell Grant eligibility, such as excluding the value of family-owned businesses and farms. Additionally, new identity verification methods, like video calls, have also been introduced.

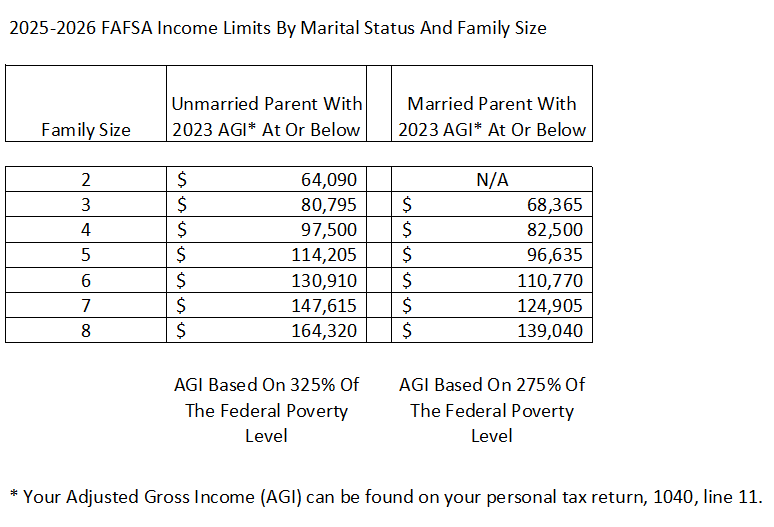

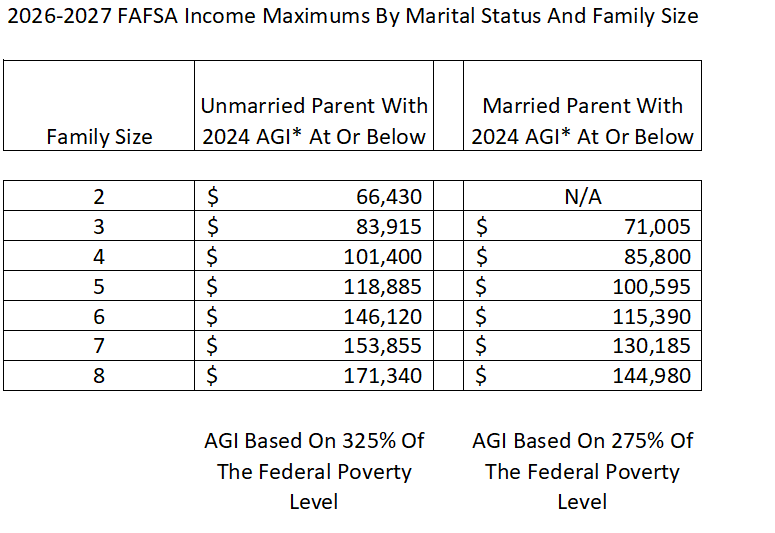

The federal grant eligibility income amounts:

The household income maximums for 2025-2026 are listed below.

The household income maximums for 2026-2027 are listed below.

The income maximums listed above are meant to be a guide to assist families on their potential eligibility for grants but other factors such as assets reported on the FAFSA may decrease eligibility.

The maximum Pell grant award for the 2026-2027 academic year is $7,395 and the minimum Pell grant award is $740. Your household income would need to be at or below the amounts listed above, based on your family size and marital status, to be eligible for a Pell grant.

The State of NJ does not publish the income maximums for State grant eligibility but families can use the federal income maximums as a guide for that eligibility as well.

What is the Student Aid Index, (SAI)?

The Student Aid Index (SAI) is a score calculated from the FAFSA that helps determine the student’s potential eligibility for federal student aid. It is not a dollar amount, but an index number ranging from -1500 to 999999, where a lower number generally indicates a greater financial need and a higher potential for receiving need-based aid.

Schools must use the SAI to determine eligibility for financial aid and it is used for awarding need-based grants, loans, and other aid types. Traditionally, the SAI cut-off for grant aid is 6655 (or higher).

A reduction in the number of questions on the form:

The FAFSA has 39 questions. Since the FAFSA on the Web is dynamic, some students will not even be presented with all 39 questions. This streamlined format will simplify the application process and make it less daunting for students and their families.

Federal tax information automatically populated:

Currently, all persons on the FAFSA must provide consent for the Department of Education to receive tax information or confirmation of non-filing status directly from the IRS. In a very small number of cases, students and families will have to enter their tax data manually, but for most, that data will be automatically transferred into the application. This change makes it easier to complete the FAFSA and reduces the number of questions to be answered.

Parents are called Contributors:

A contributor—a new term introduced for the 2024-25 FAFSA—refers to anyone who is required to provide information on a student’s form (such as a parent/stepparent or spouse). A student or parent’s answers on the FAFSA will determine which contributors (if any) will be required to provide information.

Contributors will receive an email informing them that they have been identified as such by the student, and will need to log in to the FAFSA using their own FSA ID. If the Contributor does not have an FSA ID, they can create one at studentaid.gov.

Being a contributor does not mean they are financially responsible for the student’s education costs, but it does mean the contributor must provide information on the FAFSA or the application will be incomplete and the student will not be eligible for federal student aid.

The number of students in college no longer a factor in the federal eligibility formula:

Prior to 2024/2025, the FAFSA calculated the number of household members attending college into the eligibility calculation, dividing it proportionately to determine federal aid eligibility. The application will still ask how many household members are in college, but your answer will not affect federal aid eligibility. The State of NJ will still consider it in their eligibility determinations.

For divorced or separated parents, the parent responsible for providing information on the FAFSA has changed:

For dependent students, financial information was previously needed from the parent(s) the student had lived with the most in the last 12 months prior to completing the FAFSA. With the new FAFSA that has changed, now, financial information will be required from the parent(s) who provided the most financial support to the student in the previous 12 months prior to completing the FAFSA. Therefore, the parent with the higher income must provide their information on the FAFSA.

Incomplete forms expire after 45 days:

Any FAFSA that is left incomplete will expire after 45 days, which means the form will have to be restarted and all contributors must redo their sections. Reminder emails will be sent to contributors every seven days.